Schaeffer's Investment ResearchContributor

Great Speculations

Contributor Group

Markets

Specializing in options trading for more than 35 years.

Following a blowout second-quarter earnings and revenue beat, Advanced Micro Devices (AMD) hiked its full-year forecast, citing an increase in chip demand as the work-from-home trend flourishes around the world. In response, the equity is swimming in bull notes, including an upgrade out of Susquehanna to "positive" from "neutral." Now, AMD is buzzing with options activity, hitting a record high of $77.19 earlier, and was last seen up 12.6% at $76.14.

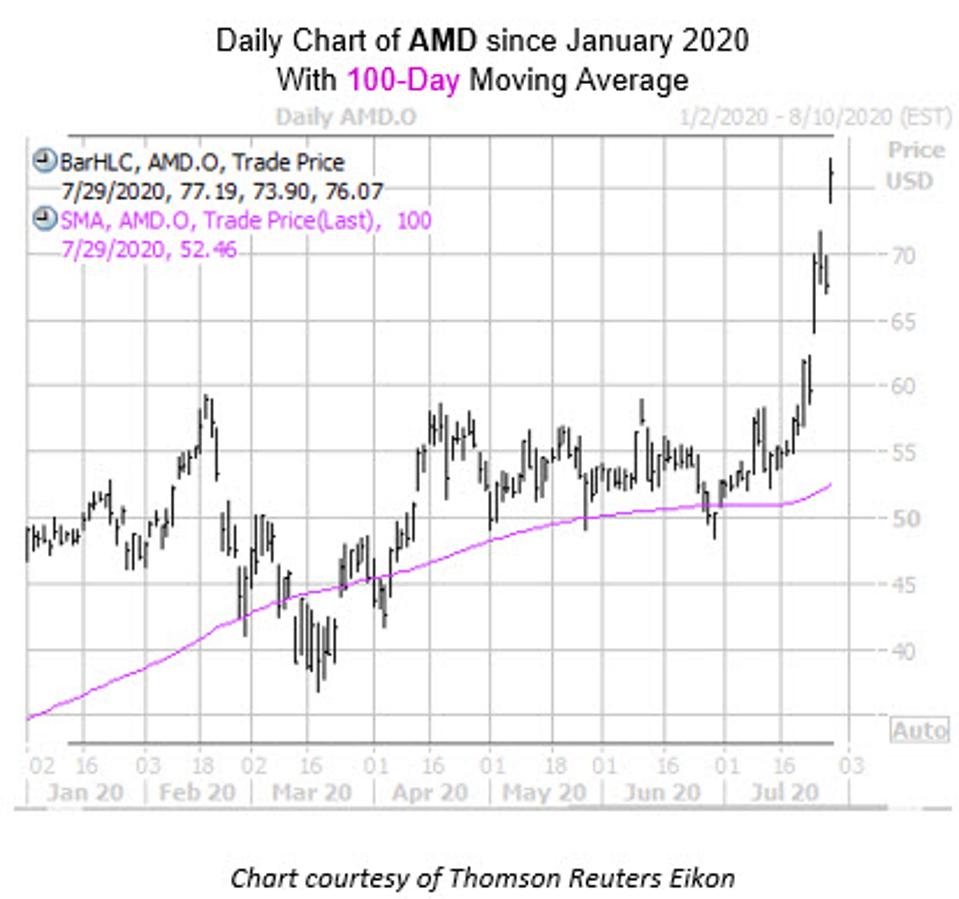

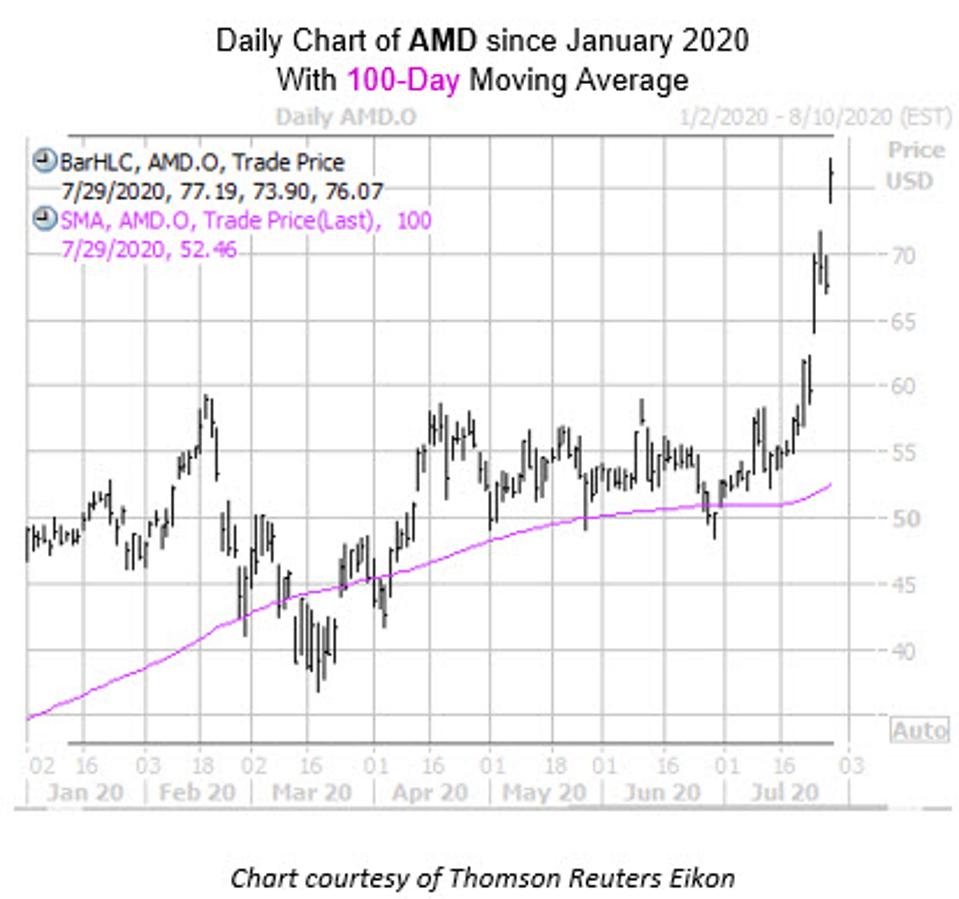

Today’s surge has AMD gapping higher for the second time this month alone, and has the stock sporting a brag-worthy 124% year-over-year gain. Supporting the shares on their impressive journey higher is the 100-day moving average.

Daily stock chart of AMD since January 2020 AMD CHART DAILY

Looking toward the options pits, volume is soaring. So far today, the chip stock has seen 705,000 call and 313,000 put contracts traded. This volume runs at double the expected rate, and in the 99th percentile of its annual range. Most active looks to be the weekly 7/31 80- and 75-strike calls.

Longer term, the sentiment has been the same. This is per data at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows Advanced Micro Devices stock with a 50-day call/put volume ratio of 3.63, ranking in the 99th annual percentile. In other terms, calls have been purchased over puts at a quicker-than-usual clip over the past 10 weeks.

Now looks like an attractive time to trade the semiconductor giant too. In fact, the stock's Schaeffer's Volatility Index (SVI) of 60% stands in just the 27th percentile of its annual range, implying that options players are pricing in relatively low volatility expectations at the moment.

Great Speculations

Contributor Group

Markets

Specializing in options trading for more than 35 years.

Following a blowout second-quarter earnings and revenue beat, Advanced Micro Devices (AMD) hiked its full-year forecast, citing an increase in chip demand as the work-from-home trend flourishes around the world. In response, the equity is swimming in bull notes, including an upgrade out of Susquehanna to "positive" from "neutral." Now, AMD is buzzing with options activity, hitting a record high of $77.19 earlier, and was last seen up 12.6% at $76.14.

Today’s surge has AMD gapping higher for the second time this month alone, and has the stock sporting a brag-worthy 124% year-over-year gain. Supporting the shares on their impressive journey higher is the 100-day moving average.

Daily stock chart of AMD since January 2020 AMD CHART DAILY

Looking toward the options pits, volume is soaring. So far today, the chip stock has seen 705,000 call and 313,000 put contracts traded. This volume runs at double the expected rate, and in the 99th percentile of its annual range. Most active looks to be the weekly 7/31 80- and 75-strike calls.

Longer term, the sentiment has been the same. This is per data at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which shows Advanced Micro Devices stock with a 50-day call/put volume ratio of 3.63, ranking in the 99th annual percentile. In other terms, calls have been purchased over puts at a quicker-than-usual clip over the past 10 weeks.

Now looks like an attractive time to trade the semiconductor giant too. In fact, the stock's Schaeffer's Volatility Index (SVI) of 60% stands in just the 27th percentile of its annual range, implying that options players are pricing in relatively low volatility expectations at the moment.

Comments

Post a Comment